Accumulation and distribution are pivotal strategies employed by institutional traders in the stock market. Understanding the intricacies of these processes can provide valuable insights for both seasoned investors and newcomers alike.

- Step : Accumulation – Building the Foundation

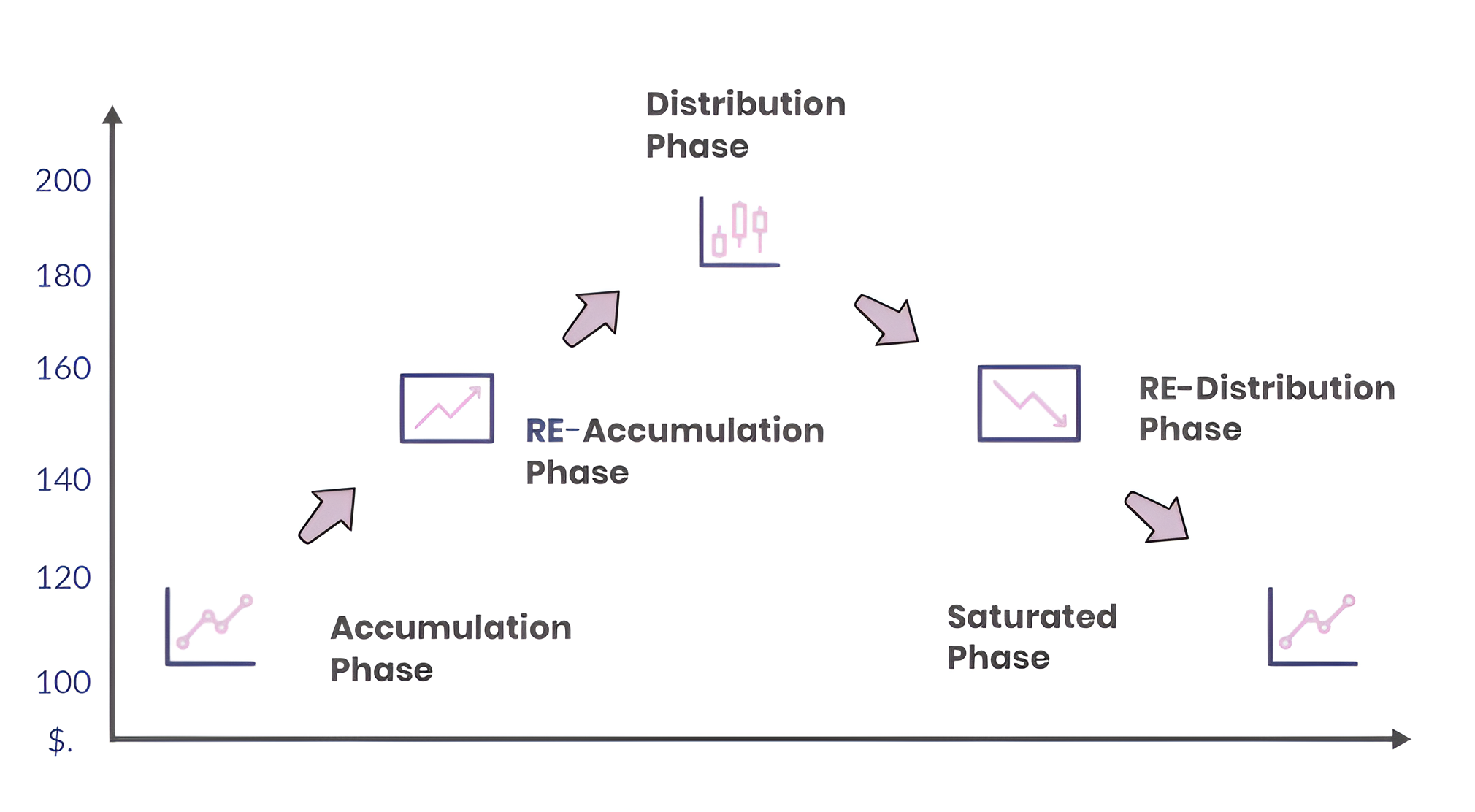

- Strategic Entry: Institutional traders strategically enter the market when they perceive a stock to be undervalued, typically initiating accumulation when the price is between $100-$105.

- Gradual Acquisition: They begin accumulating shares gradually, aiming to acquire around 60% of the available stock over time.

- Long-Term Perspective: Accumulation reflects institutional traders’ confidence in the stock’s potential for long-term growth, setting the stage for future price appreciation.

- Step : Riding the Uptrend

- Detection of Momentum: As institutional buying pressure increases, it often triggers an uptrend in the stock’s price, which savvy professionals detect and capitalize on.

- Strategic Entry Points: Institutional traders may buy additional shares at higher prices, typically around $160-$165, to ride the momentum of the uptrend.

- Maintaining Momentum: To sustain the uptrend, institutional traders may reaccumulate shares and release positive news about the stock, further fueling investor interest.

- Step : Distribution – Maximizing Returns

- Optimal Selling Point: When the stock price reaches a desirable level, typically around $200, institutional traders begin distribution, selling off their accumulated shares into the market.

- Triggering Decline: The influx of shares into the market from distribution causes the stock price to decline, returning to the $160-$165 range.

- Perceived Opportunities: Retail traders observing the dip may perceive it as a buying opportunity, aiming to lower their average purchase price.

- Re-Distribution: However, as the stock reaches saturation, professional traders and institutional traders execute re-distribution, causing the price to plummet back to $100.This process will continue again.

Conclusion

Accumulation and distribution strategies are integral components of institutional trading tactics. By mastering these processes, traders can capitalize on market dynamics, navigate price fluctuations, and ultimately maximize returns. Understanding the cyclical nature of accumulation and distribution provides invaluable insights for investors seeking to enhance their trading prowess in the dynamic landscape of the stock market.

Great

Thanks